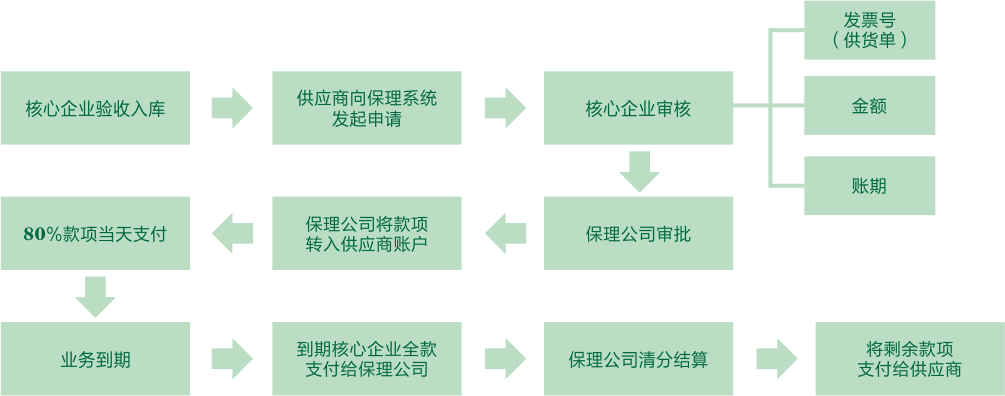

Established in 2017, Huzhou Wuxing Chaoqi Commercial Factoring Co., Ltd. mainly manages business of supply chain financial services, which is centered on the core enterprises including listed companies, key enterprises, “Golden Elephant & Golden Ox” enterprises, “High-Tech & High-Growth” enterprises in Huzhou city. After the core enterprises have received the products delivered by the suppliers, finished acceptance check, and put them into warehouse, the suppliers can apply to Chaoqi Commercial Factoring Co., Ltd. for financing with the warehouse warrant issued by the core enterprises. At the same time, Chaoqi will provide suppliers with a complete set of loan settlement service.